The Fantom Menace

An elaborate scheme has come to an end.

Fantom, Solidly, SpookySwap, Abracadabra, Geist: multiple projects all entwined into a system designed to extract maximum value for a small set of insiders who are now steadily exiting the stage.

The transparency of crypto is key, but even on-chain actions can be deceiving.

Behind closed doors, builders conjure populist narratives, which rarely have happy endings for the users that buy into them.

DeFi is as corrupt as TradFi, maybe worse.

To take one example…

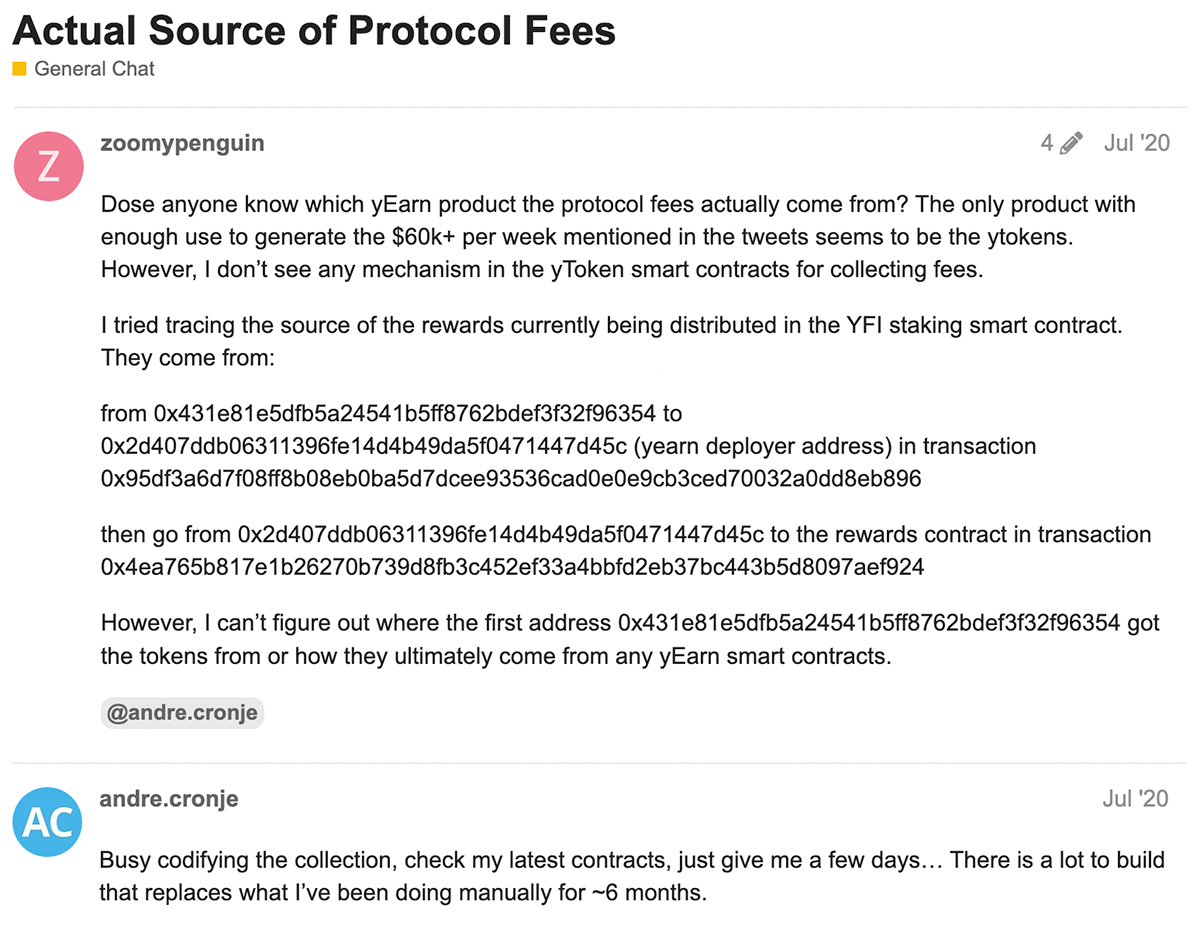

In our investigation into the Curve Wars (8th July 2021), we looked at one of the early YFI farming wallets: 0x431e81e5dfb5a24541b5ff8762bdef3f32f96354.

In that article, we wrote:

Nansen lists 0x431 as being the first wallet to farm YFI. As well as holding a large amount of K3PR, this wallet is also now voting to increase the gauge weight of the Fantom pool, so perhaps you can draw your own conclusions.

When we heard the recent news about the Fantom team, we returned to that specific wallet to see if anything had changed.

Whale moves.

We found that 0x431 had an unmatched level of power over the entire network, all in the hands of one EOA wallet.

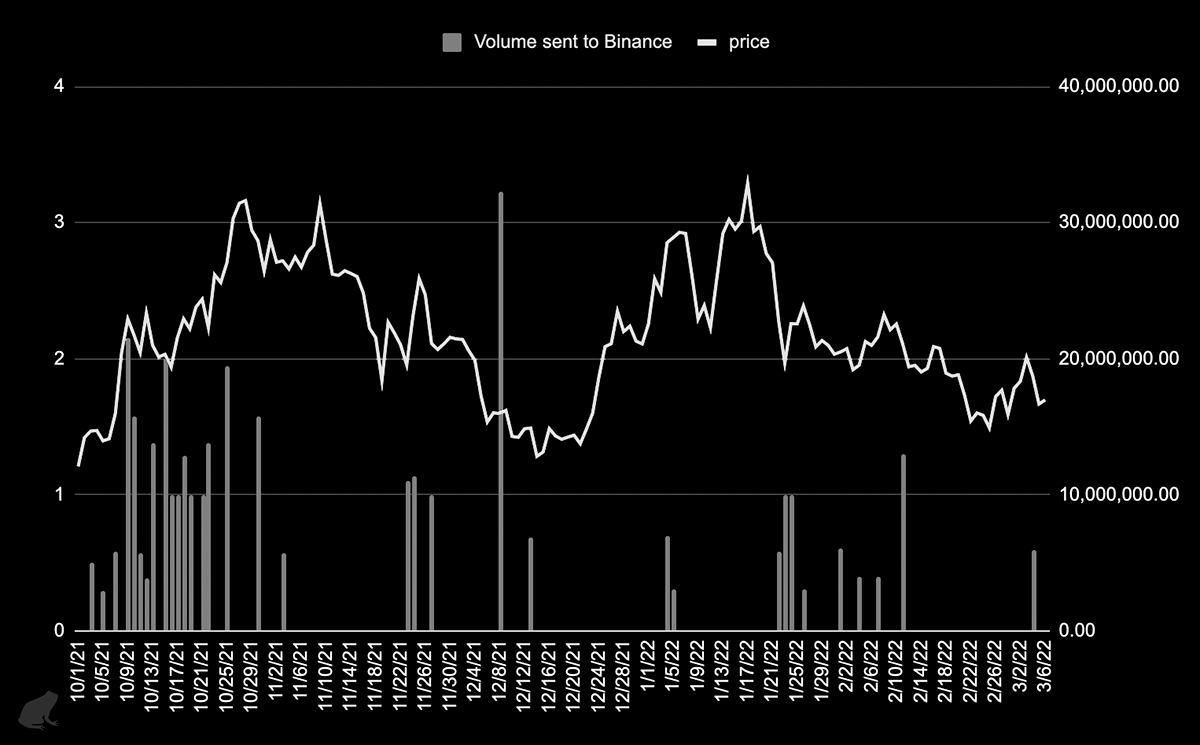

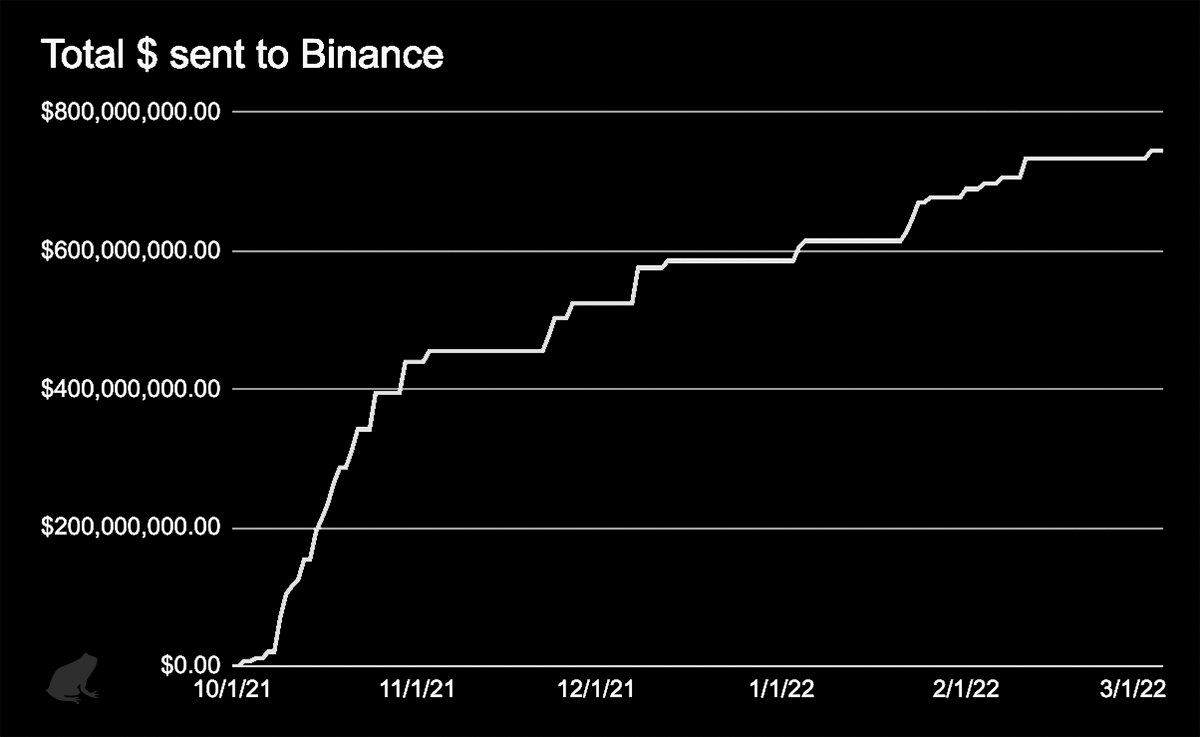

This single wallet sent out a total of ~$750M in FTM over the last 5 months, using another address as a buffer before sending to Binance.

Some other movements also stood out, as FTM was first bridged from the FTM Chain to Mainnet, before being sent to the centralised exchange.

Why would they bridge these funds while Binance has provided direct FTM deposits and withdrawals since March 2021?

Did 0x431 cash out?

Some readers will notice that the majority of the moves were made during a period of increased FTM FOMO, in great part created by the eye-catching announcement of a 370M FTM incentives program to build on FTM launched on the 30th August 2021.

You can find the data behind these charts in our spreadsheets here.

We also noticed that some 60M FTM were sent to another wallet, 0x579.

We approached Fantom for further details about the wallets in question.

rekt:

Do you know who controls 0x431e81e5dfb5a24541b5ff8762bdef3f32f96354?

Fantom:

The Fantom Foundation.

rekt:

Do you know who controls 0x57900b3dc6206994d3b2d593db8f6c6bfdbb61a9?

Fantom:

The Fantom Foundation.

rekt:

Are the 0x57900 funds supposed to be for the incentives program announced in August?

Fantom:

Yes in part along with other FTM that the foundation holds.

rekt:

100M FTM were transferred from 0x431 to a new multisig 4 days ago, and 60M FTM to 0x57900. Do you know what these funds are for?

Fantom:

Moving funds between Foundation wallets.

rekt:

The Fantom Foundation was the first wallet to farm YFI?

Fantom:

Yes we have been defi farming to build up treasury reserves.

rekt:

Why are you not using a multisig to store the foundation funds?

Fantom:

We have both. Moving more funds to multisig over time.

rekt:

Over the last 5 months, 0x431 has sent ~345M FTM ($750M) to Binance.

What was this used for?

Fantom never replied

We will let our readers make up their own mind in regards to what happened to the 345M FTM, but we can provide some background on some of the Fantom Foundation replies.

Due to the opacity of centralised exchanges, this is not conclusive evidence, but it certainly correlates with our suspicions.

The following price charts are taken from Binance, where you can see the price impact after the inflows of FTM.

Oct-13-2021 13.79M FTM ($18.3M) sent to Binance, price dumps by 6.17% in the next 2 hours.

Oct-15-2021 20M FTM ($26M) sent to Binance, price dumps by 6.2% in the next 4 hours.

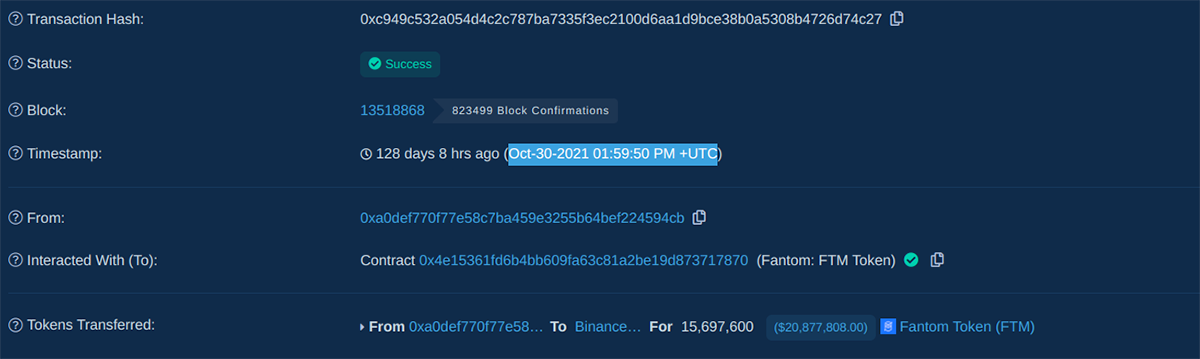

Oct-30-2021 15.6M FTM ($20.8M) sent to Binance, price dumps by 7% in the next 24 hours.

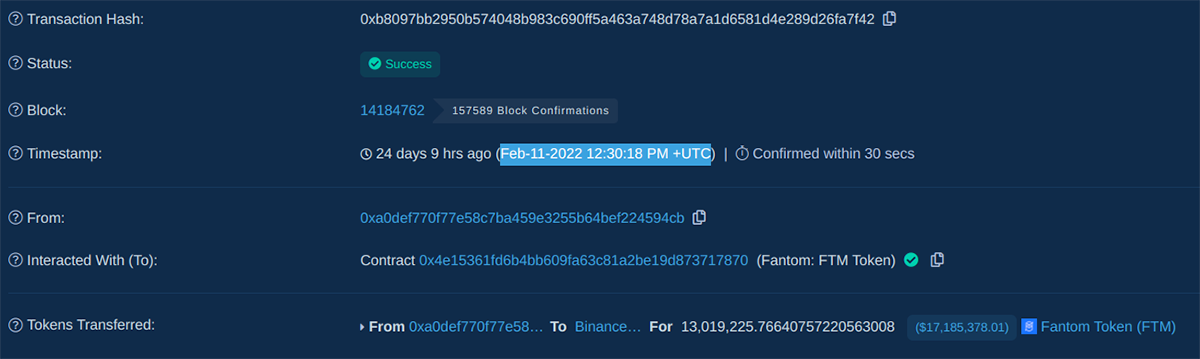

Feb-11-2022 13M FTM ($17M) sent to Binance, price dumps by 12% in the next 18 hours.

FTM holders may be concerned to see that these moves to Binance might not be over.

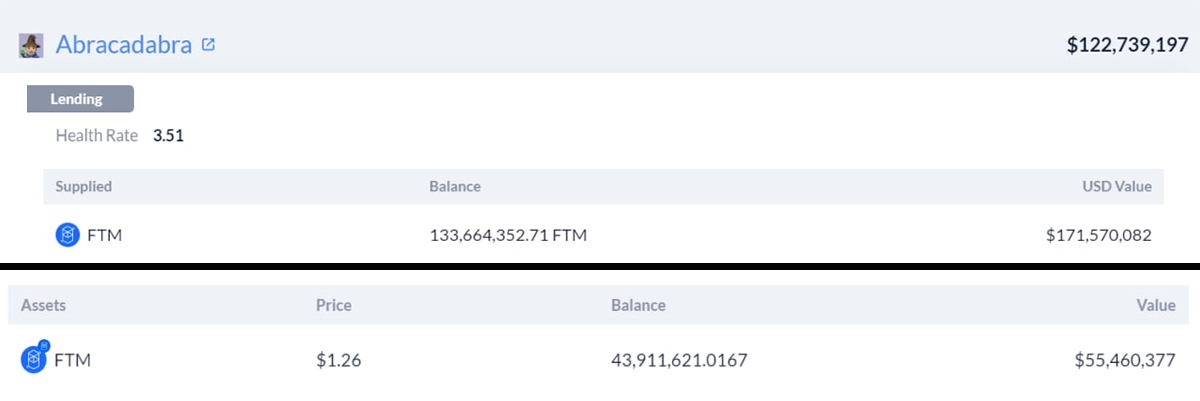

0x431 is still in possession of $171M in FTM as collateral in Abracadabra, as well as another ~$55M in loose FTM across the Ethereum and Fantom chains, bringing the potential damage close to $1B+.

Mismanaged funds?

In our interview, the Fantom Foundation told us that the 60M FTM sent onto 0x579 was intended for the incentives program. Why were these funds not on a multisig?

Either the foundation is lying, or this is a gross mismanagement issue from the Fantom Foundation.

What would happen to the project if this individual could no longer be contacted?

Basic operational security measures are simply not being met, and this alone should be worrisome for FTM users.

Will the funds be moved to 0x0b2, alongside the 100M recently sent to that multisig?

The claimed 370M FTM incentives also seem a bit off, as we are only reaching a total of 166M if we include the 6.8M FTM sent by 0x431 a week ago.

Finally, despite their claims of “moving more funds to a multisig over time”, at the time of our interview, except for 100M FTM moved earlier this month, the only multisig on FTM had just 1.9M FTM, and this was the 45th biggest holder.

There was no large multisig FTM holding on ETH either.

Who is 0x431?

There seems to be many different opinions on who the real owner of 0x431 is.

In October 2021, the CMO of Fantom was confronted about the actions of 0x431 in the following livestream with Alex Svanevik from Nansen.

At 16:45, you can see both individuals break out into nervous laughter when they come across the address in Nansen, where it is labelled as “1st YFI farmer”.

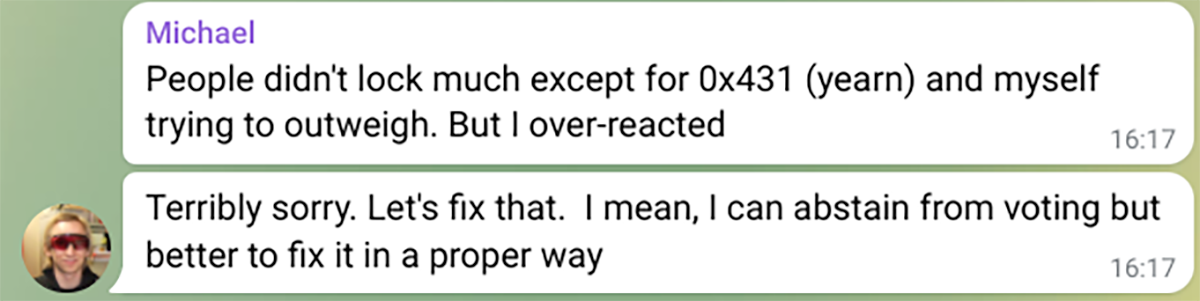

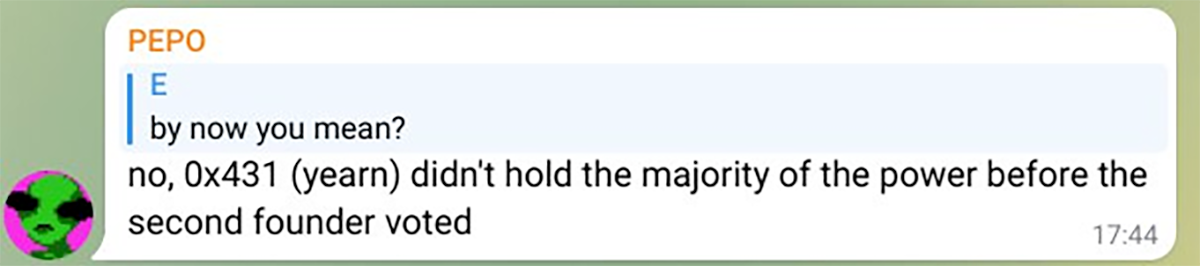

We searched the wallet address in the Lobster DAO Telegram group and found the following messages posted back in Aug 2020 from Michael, the founder of Curve, and from PEPO, a hardcore Yearn fan.

0x431 is also labelled in this forum post as being a source of rewards for the YFI staking smart contract, which were manually distributed at that time.

Andre Cronje can be seen to respond to the query.

We are yet to understand why one would be "defi farming to build up treasury reserves" while sending rewards to another project, which is then on a different chain than the one you are trying to promote.

Fuel the hype machine.

Whales need a significant amount of liquidity to move without making a splash. To create that liquidity, you need partnerships. This is normally achieved by announcing a massive incentive program to attract projects onto your chain, or by creating a new project with an airdrop based on a competition on the TVL of projects onto your chain, then simply wait for the FOMO to begin.

The following chart from DeFi llama shows the impact of focused promotions to increase the TVL on the Fantom chain.

There’s nothing wrong with promotion, we’re simply explaining the game…

Here are some notable dates behind the moves in TVL on Fantom.

October 6th - Launch of Geist, a project for which the token got dumped straight at launch

October 7th - Yearn announces Iron Bank on Fantom

January 10th - Solidly Snapshot announcement

February 24th - Solidly launch ($SOLID farming)

March 6th - Anton Nell announces him and Cronje quitting

On top of announcing the incentives, it appears that 0x431 was getting closer to projects operated by Sesta and Sifu.

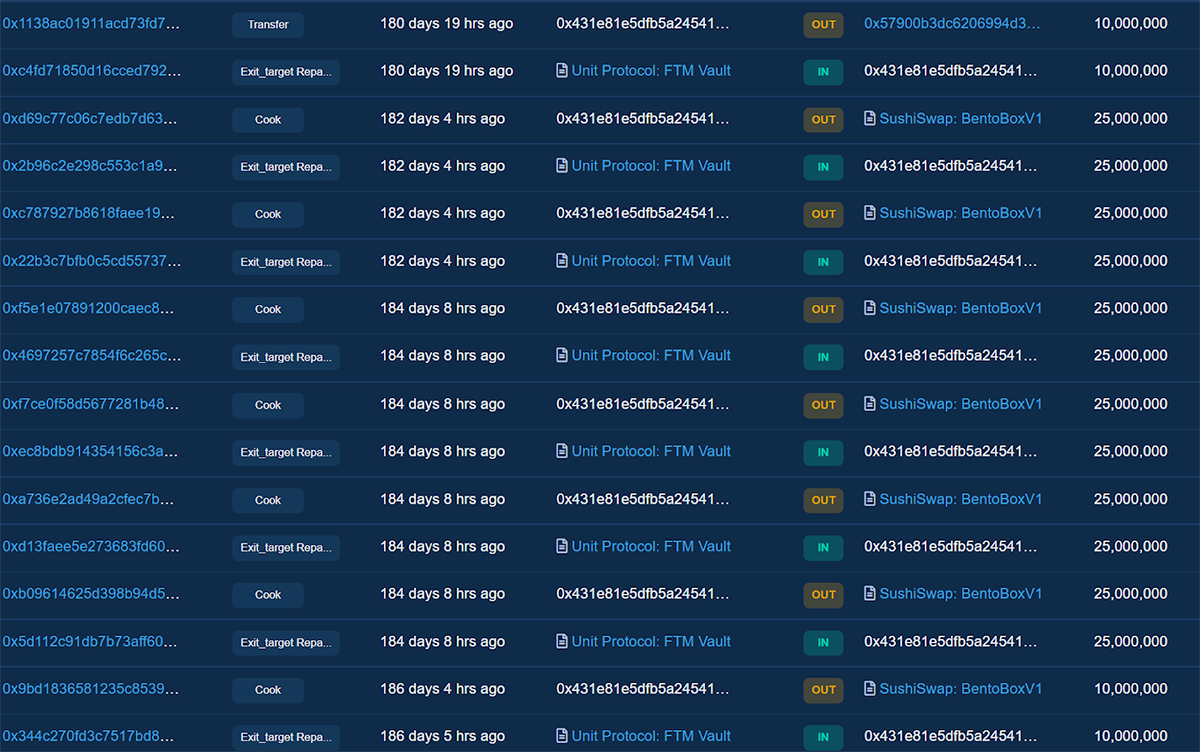

The amount that $FTM was publicly mentioned by Daniele increased sharply around the beginning of September 2021, around the time when funds were moved from Unit protocol to Abracadabra. (labelled as Bentobox on Etherscan)

I scratch your back, you scratch mine.

The same names linked to previous shady stories keep on appearing, and despite their meddling, it seems that retail is always asking for more.

No such thing as a fair launch?

When it comes to new projects, it seems 0x431 is not the one to share when the latest “fair launch’’ comes around, as 30% of the IFO share was taken by this single wallet.

Testing in prod

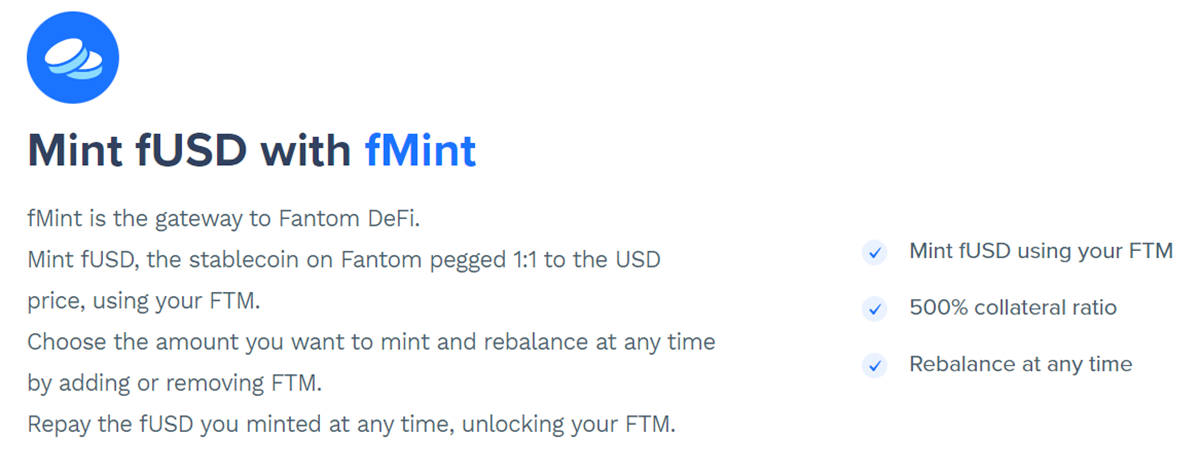

Finally, a rekt reader sent us some questionable content about the Fantom stablecoin, fUSD.

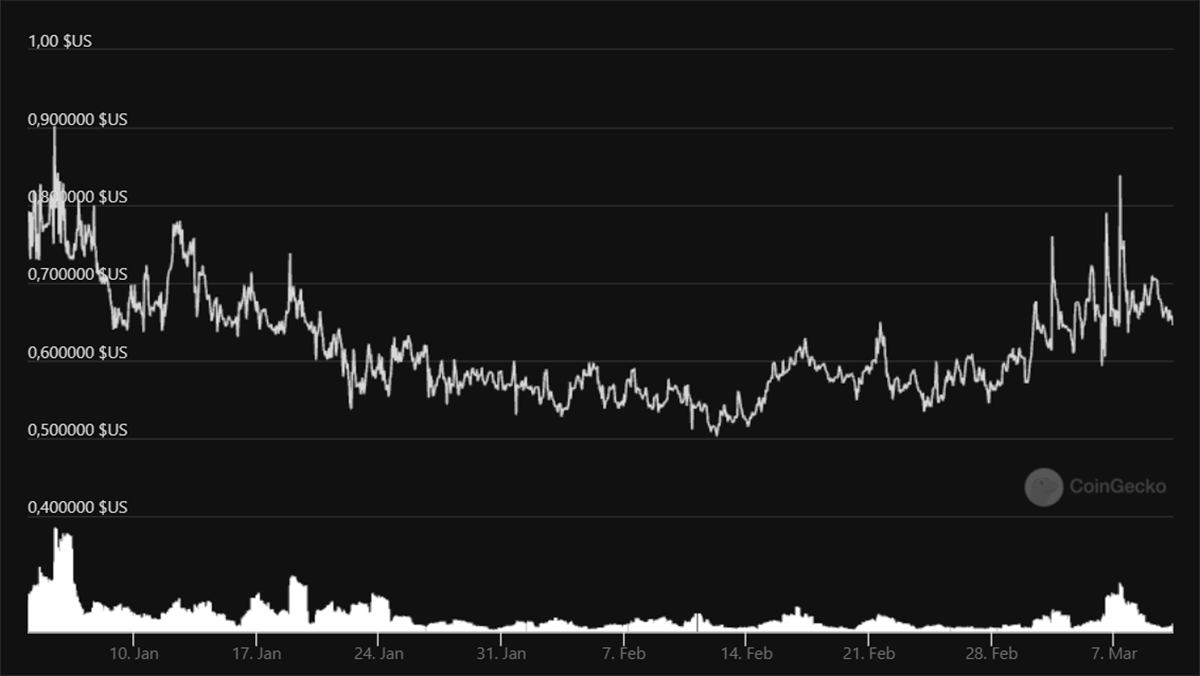

$FUSD is the Fantom native stable coin backed by Fantom Opera, except it’s not stable and it’s not pegged to 1$USD for close to a year.

This is a huge risk for the staker-minter:

In order to secure the fantom network, $FTM is staked using the Fantom foundation website. These staked $FTM can be used to mint $sFTM that are used as collateral in order to mint the fantom native “stable” $FUSD. According to the Fantom Foundation website, you can mint FUSD at a 1:1 ratio to the USD price.

The issue is that $FUSD is not stable and not pegged at all. This is because there is no liquidation implemented yet.

Users who are minting and selling their $FUSD will get ripped off if $FUSD holds peg.

For example:

Let’s suppose a user minted and collateralised at 500%, meaning that 100 FTM priced at $1.36 will allow him to mint 27.2 $FUSD.

However, because $FUSD is worth around 0.70 $USD, he is getting only 19$USD.

The only use of $FUSD is to be sold in order to buy other tokens.

The moment liquidation starts to be activated:

If $FUSD starts to hold the peg all things being equal and the price of $FTM decline to 0.81 the user would need to buy back $FUSD spending 27.2$ in order to avoid liquidation.

This would result in a loss of 43%.

Rekt in prod.

Based on these findings, Fantom looks more like a centralised money-making scheme with little care for its user base than the decentralised philanthropic network that they claim to be on their website.

Getting dumped on is nothing new, but the scale of this operation is unlike anything we’ve seen before, and considering we have only explored one address, this could be just the tip of the iceberg.

So many of the current new L1 protocols follow a set format:

- Launch exciting new EVM chain (always faster than Ethereum)

- Announce multi-million dollar incentive program or finance projects to fork ethereum projects in order to increase TVL. (Solidly (Curve modification), SpookySwap (fork of Uniswap V2,), Geist (fork of Aave ) are prime examples).

- Spin up a nice narrative for retail to buy in.

- Provide insiders and VCs with exit liquidity.

- Chain breaks or becomes expensive because it can't withstand usage.

Fantom was no exception.

Our findings suggest that in the best case scenario, Fantom is showing gross mismanagement of their foundation funds, and in the worst case, the entire network has been misappropriated in order for one individual to take as much profit as possible.

If 0x431 is performing treasury management by Cronje on behalf of Fantom, as the Fantom CMO claims in this video, then why have the funds not been transferred to a new multisig after Cronje’s departure from DeFi?

If 0x431 belongs to the Fantom Foundation, as they claimed in our interview, then why were they feeding Yearn fees back in 2020?

Alternatively, if 0x431 does not belong to the Fantom Foundation, then we’ve all been lied to, and we are left wondering who they are covering for…

If we’ve made mistakes in our investigation, we are open to being corrected, but the evidence presented is all on-chain, and the interview is unedited.

At the very least, we need more transparency from Fantom, and if they really do own 0x431, then they would do well to transfer to a multisig.

Our findings are from just one address. We can only wonder if this is only the tip of the iceberg.

Looking back at the general state of the market, it is hard to not have mixed feelings about what our industry has achieved.

Yes, tremendous innovation has arrived, new ways of transferring wealth have arisen and many new people have joined this movement, from which they are now making a living and participating in this remote working economy.

Like the internet in the early 90s, a wave of change is coming, one that will permanently change the world. But around this movement, retail must constantly pay attention and take care not to fall for the latest hype.

Frog Nation, (3,3), Cronje coins, so many narratives have been bought by retail, only to be sold by insiders.

It seems like one “fair launch” allows you to get away with much more questionable behaviour in future.

We set our industry apart with the label of “decentralised”, but are our morals and actions any different from traditional finance? A lack of KYC supposedly protects us from the government, but also enables the actions of hackers, scammers, and predatory builders who play the game well, then leave with more money than you.

Considering the amount of money involved, it is hard to imagine that organisations such as the SEC are not already investigating these stories. The lack of regulation in DeFi provides a nice shelter for people to get away, but much of the behaviour we witness would easily be labelled as organised crime in traditional markets.

Everyone should be entitled to seek riches, but not at the cost of deceiving others.

Uncensorable code will continue to be built, and perhaps long term this will benefit the masses, or at least those who need an alternative economy.

But in the meantime, less informed users looking for investments are walking into a minefield.

Is zero regulation really the best option? How much longer will we, or our governments, tolerate these excessive, repetitive, fraudulent behaviours?

It remains to be seen how regulation will evolve on-chain, but in the meantime, all we can do is try not to get rekt.

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.

you might also like...

Tomb Finance - REKT

The raid of Tomb Finance makes for Fantom's first fatality. The Tomb team say it wasn't a hack, but we’ll let the rekt readers be the judge of that.